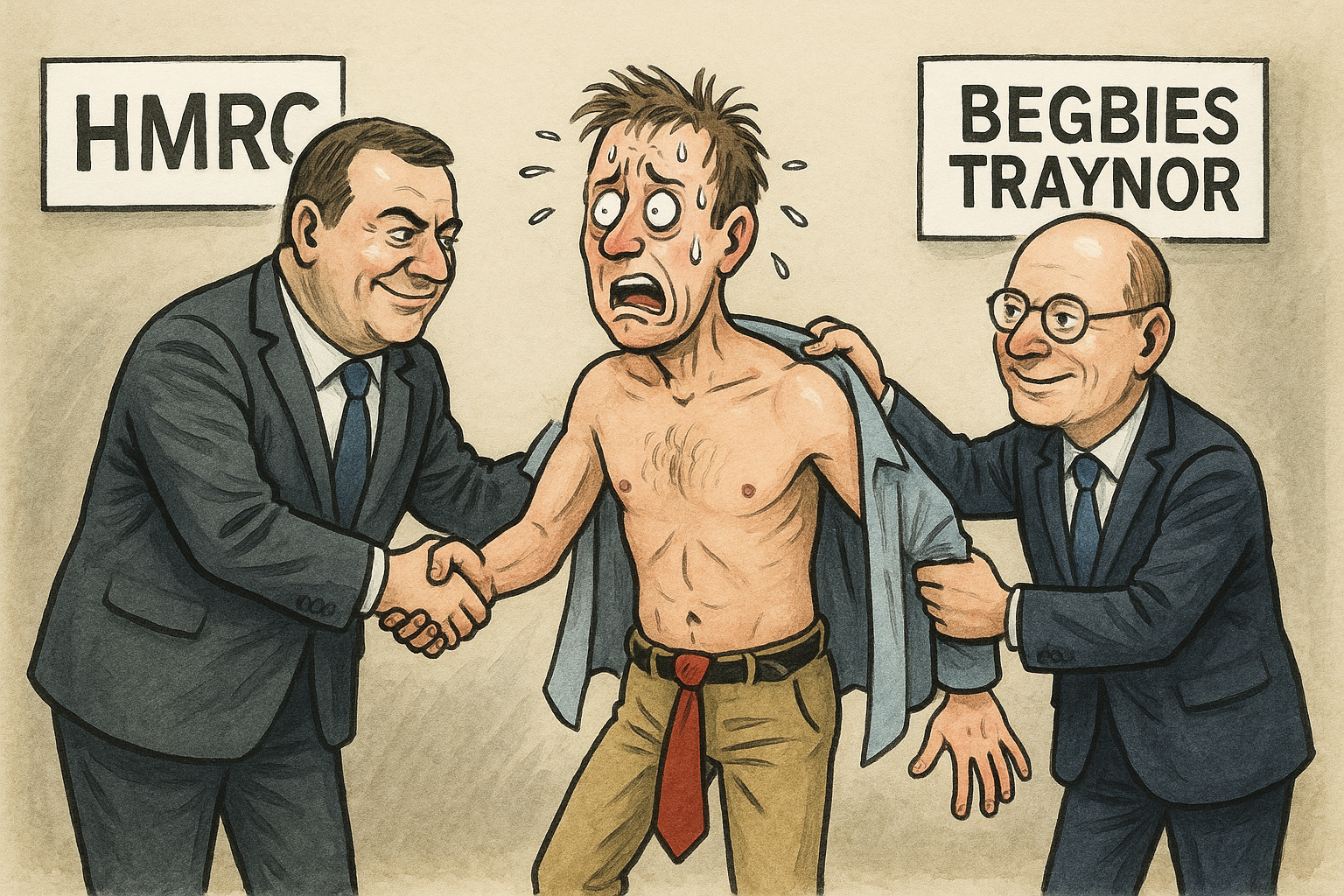

If you are a director facing mounting pressure from creditors, a curve of HMRC arrears, or the prospect of a Creditors Voluntary Liquidation, you are usually told to do three things before anyone else sees relief: find the money to fund an insolvency process, accept extensive scrutiny of every decision you made under strain, and carry personal exposure if an office holder reads your conduct uncharitably. That burden explains why so many directors look for a better option.

The state often frames anything outside the standard insolvency toolkit as avoidance. The more sensible question is why directors seek alternatives. If the conventional path were consistently affordable, proportionate and predictable, the demand for lawful restructuring routes would collapse. Resistance to alternative solutions frequently sounds like a defence of process rather than outcomes.

The headlines are familiar. Enforcement stories feature directors who handed their failing companies to nominal successors who did little more than take control of shells, verify nothing and let the structures wither. Those failures were not caused by the idea of a company sale. They were caused by poor execution, lack of governance and the absence of a genuine going concern strategy.

Previous crackdowns show the same pattern. Some intermediaries sold distressed company takeovers with promises that directors could walk away from everything. The Insolvency Service intervened because assets were not valued properly, liabilities were not managed, and creditors were not treated fairly. The problem was never the idea of a sale; it was the lack of substance behind it.

Other banned operators repeated the formula. They replaced directors without checks, ignored record-keeping, and allowed value to vanish. This kind of theatre gives going concern transfers a bad name, even though well structured, well documented transfers can protect value, preserve jobs and deliver better commercial outcomes than liquidation.

Now set aside the noise and look at what a CVL is supposed to offer. On paper it provides an orderly wind down overseen by an Insolvency Practitioner, with assets realised and distributed through a rule-set. In practice it is expensive, disruptive and often leaves unsecured creditors with little to nothing. Directors pay to lose control and then wait for judgments on historic decisions. It is a formal mechanism, not a value-preserving one.

For many SMEs, the lived experience of a CVL is that it drains scarce cash, adds delay and ends with outcomes that benefit neither the director nor the majority of creditors. You fund the process, you hand over your company immediately, and you undergo a conduct review in which every decision can be revisited with perfect hindsight. It rarely aligns with the practical realities of running a small business under pressure.

That is the gap Director Freedoms fills. Instead of selling a dream of walking away from chaos, we purchase companies as genuine going concerns, step in as successor managers, work directly with major creditors including HMRC, and drive liabilities down through lawful, transparent restructuring. We do not abandon the shell. We manage it. In the past two years alone we have successfully offset more than two million pounds of HMRC liabilities for directors who would otherwise have gone straight into liquidation.

There is a clear legal boundary. Once insolvency is imminent, directors owe duties to creditors. Improvised asset shifts, back-door closures and unverified takeovers cross that line. A compliant going concern transfer does the opposite. It values assets independently, ensures proper consideration is paid into the old company, and documents creditor engagement. It preserves value rather than hiding it.

The deeper issue is structural. Traditional insolvency routes depend on fee-earning firms whose costs absorb recoveries long before unsecured creditors receive a return. Meanwhile the regulator leans on that same network for enforcement intelligence. In small cases the hierarchy is predictable: the office holder gets paid, the state gets data, and the creditors who matter most to SMEs see crumbs.

Language shapes perception. Insolvency avoidance sounds inherently dubious, despite the fact that the law allows multiple legitimate strategies that protect value: time to pay with HMRC, structured forbearance, responsible going concern transfers with real consideration and full audit trails. The question is never whether you avoided a courtroom formality. The question is whether creditors are treated transparently and fairly.

What official messaging rarely addresses is the underlying demand. Directors do not choose complex alternatives because they enjoy variety. They choose them because the mainstream route is too costly, too slow and too punitive for low-asset companies. Without addressing that reality, enforcement becomes a repetitive cycle that never fixes the market deficiency that drives directors elsewhere.

If you want to protect yourself, your staff and your reputation, the answer is to act early and within the rules. At Director Freedoms we assess options at triage stage without any requirement that a CVL must follow. We acquire the company as a going concern, implement creditor strategies that reduce exposure, and create a compliant exit that avoids the personal risks associated with unmanaged collapse.

Success will not come from pretending liquidation works for every SME. It comes from creating lawful, well governed alternatives that are affordable, transparent and effective. The results speak for themselves: more than two million pounds of HMRC liabilities mitigated or offset in the last two years, directors avoiding unnecessary liquidations, and companies moved on cleanly without the chaos of makeshift operators. Director Freedoms exists to provide that practical, compliant pathway where the system otherwise offers only a single, costly door.