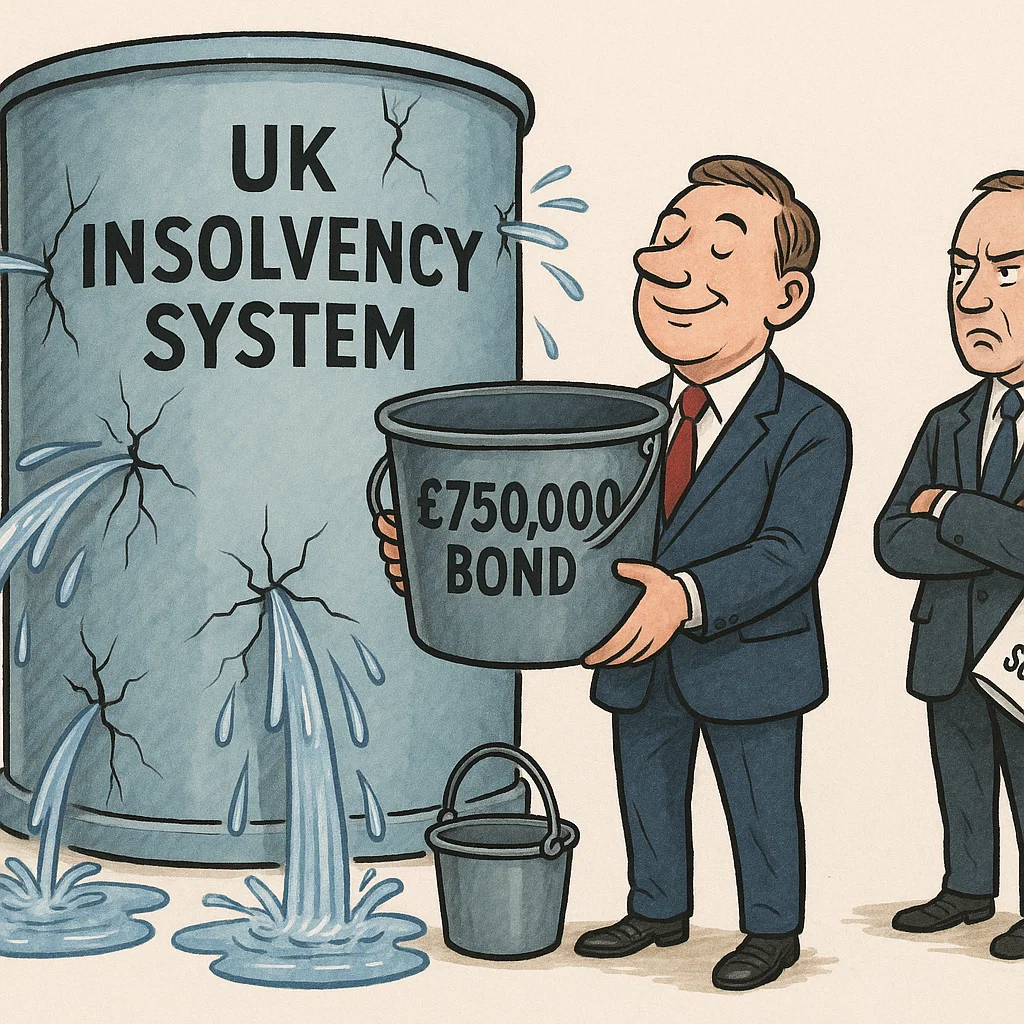

Northern Ireland has quietly made one of the most telling admissions about the UK’s insolvency system in years: the fraud bond for insolvency practitioners (IPs) is being increased to £750,000. That is not the sign of a healthy, trusted regulatory framework - it is the sign of a system that has failed to control its own practitioners. The Department for the Economy has issued the Insolvency Practitioners (Amendment and Transitional Provisions) Regulations (Northern Ireland) 2025, effective 9 December 2025. While newspapers will write this up as a ‘technical update’, directors should recognise it for what it is: a response to misconduct, a shrinking tolerance for the insolvency profession’s black-box behaviour, and a shift in leverage for anyone harmed by IP wrongdoing.

Every licensed insolvency practitioner must carry a bond that pays out if their dishonesty causes a financial loss. That concept alone tells you something: very few regulated sectors require mandatory fraud insurance at this scale. The structure has two layers - the case-specific penalty sum, and the general penalty sum that covers cases where the first layer is missing or exhausted. This bond does not cover incompetence, bad judgement, or the everyday losses caused by poor IP decision-making. It covers only fraud and dishonesty - the very conduct the industry insists is ‘rare’. If it were rare, the government wouldn’t be tripling the bond.

The general penalty sum rising from £250,000 to £750,000 is not a small tweak; it is a 200 percent increase acknowledging the size of the damage some IPs cause. Historically, many estates hit the £250k ceiling long before the real loss was accounted for - especially in cases where assets were mishandled, mis-sold or misappropriated. The new limit means more room to claim back what was taken. But the deeper truth is this: if directors were genuinely protected by the current regulatory regime, the government would not need to triple the insurance to cover IP dishonesty. The industry’s defenders cannot spin their way out of that.

Interest on losses must now be paid at a rate above SONIA, from the moment the loss occurs to the moment the bond pays out. In practice, this financially punishes delays and obstruction. And obstruction is common: IPs and sureties have historically dragged out claims to frustrate directors and creditors. This new rule acknowledges that stalling tactics exist - again, telling you something about how the industry behaves in the shadows. Directors should document exactly when each loss crystallises and challenge any attempt to apply vague ‘statutory interest’. The law now demands SONIA-plus.

Another important shift: the bond must now cover the reasonable costs of the successor insolvency practitioner who has to investigate the misconduct. Historically, estates were abused twice - first by the rogue IP, then by the cost of cleaning up their mess. These regulations finally admit that the clean-up costs should not fall on creditors. But let’s be clear: this change would not be necessary in a system that wasn’t plagued by mis-selling, asset undervaluation, deliberate obfuscation and IPs acting beyond their proper authority. Raising the bond is damage control, not reform.

A minimum two-year run-off window is now required, protecting late discoveries of dishonesty. Directors often find out the truth only after the estate is closed, books arrive late, or discrepancies surface through suppliers or HMRC. This change acknowledges that IP wrongdoing is often uncovered only after the practitioner has conveniently walked away. The two-year floor reflects the uncomfortable reality that many investigations of IP behaviour begin long after the formal release.

Another rule targets time-limited cover. Where a bond applies for only a set period, the minimum is now six years from the practitioner’s appointment - extendable, and extensions cannot be unreasonably refused. That is because fraud and manipulation of insolvent estates often emerge long after the event. Directors should diarise this six-year point and request confirmation of cover well in advance. Silence, delay or refusal should immediately be escalated to the authorising body.

Sureties must now give at least 60 days’ written notice before a bond expires. This stops practitioners from letting cover quietly lapse - a tactic that has left directors and creditors exposed in the past. Under these new rules, cover remains in force until the surety has properly given notice. If anyone tells you a bond has expired without warning, demand the statutory notice and escalate if it cannot be produced. No notice, no expiry.

Transitional rules mean the changes won’t apply to every case before 2027. Practitioners appointed before 1 January 2027 may still rely on older, weaker bond requirements. Directors must therefore check both appointment dates and bond issue dates to know which regime applies. In other words: do not assume protection. Verify it. And if your case sits under the old rules, you should be even more demanding and assertive - because those claims will be the easiest for rogue practitioners to hide behind.

If you suspect misconduct, your next steps are simple and must be taken in writing. Request: the bond details, the specific penalty sum, the availability of the £750k general sum, the SONIA-plus interest calculation, the SPS indemnity period and any extensions, and the run-off end date. Then instruct the successor practitioner - or an independent expert - to quantify every relevant loss, including interest and the entire cost of re-doing the estate administration. Under the new rules, you are entitled to it.

If a surety tells you a claim is out of time, check the two-year run-off and the six-year indemnity period. If they claim the bond has expired, ask for the statutory 60-day notice. If they refuse an extension, demand written reasons and the premium required. If an IP has been removed for cause, insist all clean-up costs fall against the bond. In this world, documentation, persistence and accuracy win. IPs rely on directors not understanding their rights - that era is ending.

For directors in Northern Ireland, this new regime is more than a technical adjustment. It is an admission that the existing insolvency system - and the conduct of some within it - has failed to uphold public trust. Raising the bond to £750,000, adding SONIA-linked interest, introducing run-off protection and penalising silent expiry only happen when a system’s flaws are too large to ignore. Director Freedom’s view is simple: the insolvency regime remains a black box, built to protect practitioners, not directors. These new rules give you more leverage - but the safest route is still avoiding the insolvency machine entirely wherever possible. Reduce liabilities, correct errors, restructure sensibly, and do not walk blindly into a CVL unless every other director-led option has been exhausted.