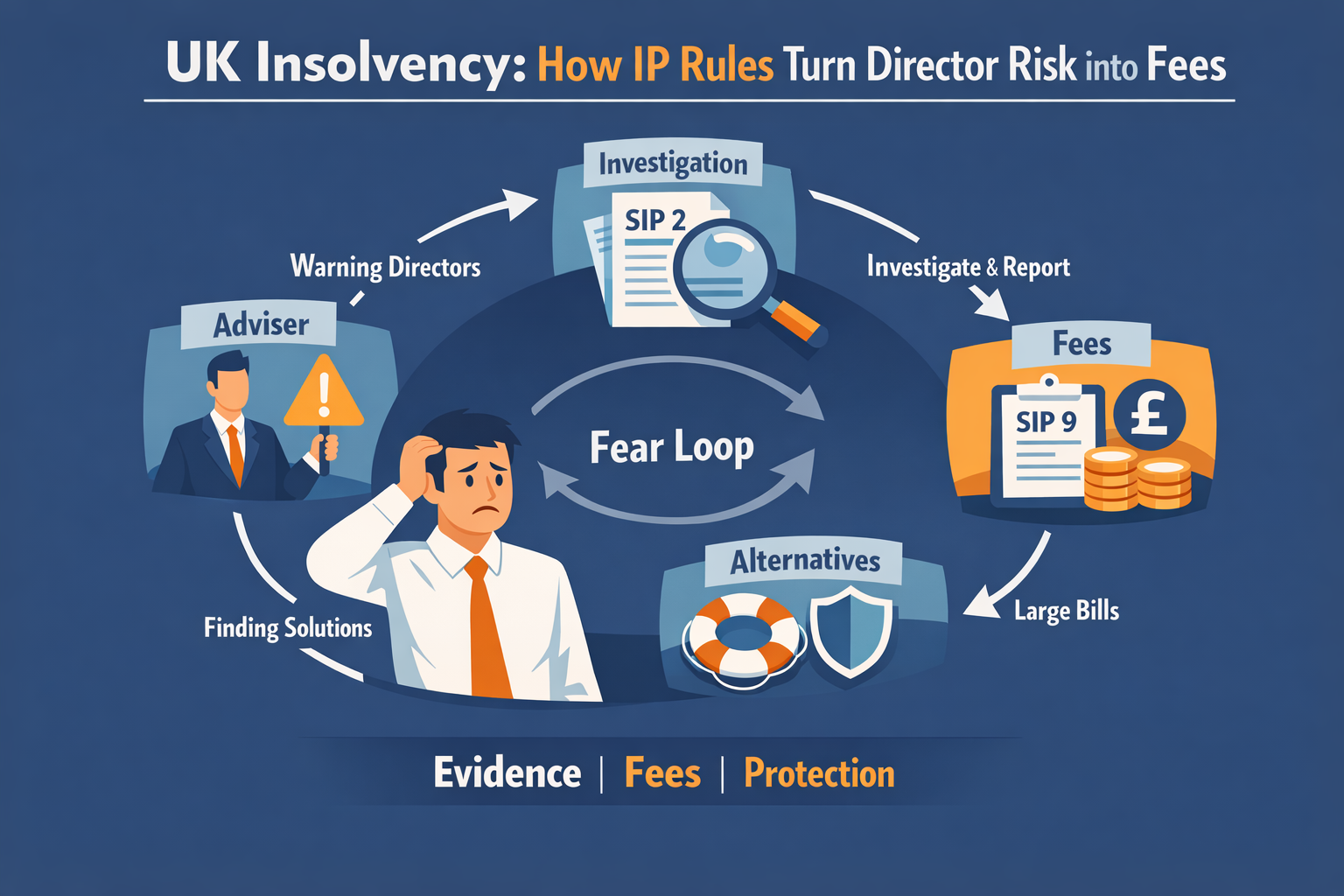

Directors tell us the same story: at the first sign of distress, advisers warn of disqualification, misfeasance and wrongful trading. Weeks later, the same firms are appointed to scrutinise those issues and bill for the work. That loop is lawful and regulated, but it is not neutral for you or your family.

Those warnings cite real statutes. Wrongful trading allows a liquidator to seek a personal contribution if, before winding‑up, you knew there was no realistic prospect of avoiding insolvent liquidation. Preferences, transactions at an undervalue and misfeasance let office‑holders unwind payments and pursue personal liability. (legislation.gov.uk)

Once an IP is appointed in a CVL or administration, practice rules require an investigation and a director conduct report to the Insolvency Service. That is SIP 2’s point and it is mandatory. The individual who warned you may later review your decisions and report on your conduct. (icaew.com)

How that investigative work is monetised is set by SIP 9 and the Insolvency (England and Wales) Rules 2016. Fees may be fixed, percentage‑based or time‑cost; where time‑cost is used, a detailed fee estimate and hourly rates must be provided, and the IP cannot draw more than the estimate without fresh approval. Creditors can challenge fees they consider excessive. (icaew.com)

This is not academic. In the Carillion liquidation, PwC’s special managers disclosed an average staff rate of £360 per hour, with the first eight weeks of work costing £20.4m; the court later approved £22.9m for costs to 31 March 2018, and the National Audit Office put the net taxpayer cost around £148m while government evidence indicated PwC’s total would be about £50m. (publications.parliament.uk)

In most CVLs the first letters directors receive are about the director’s loan account. Insolvency Service guidance is blunt: money drawn by a director belongs to the company and must be repaid even after insolvency. Where records are messy, office‑holders reconstruct the ledger and, if needed, run a misfeasance claim under section 212, with case law such as Re Mumtaz showing how courts approach overdrawn accounts. (gov.uk)

That is why many directors feel blindsided. You were told to be candid, then faced with broad document requests, firm‑worded allegations about accounting entries and pressure to settle ‘to save costs’. The frustration is not scrutiny itself; it is the gap between what was implied at the start and how the appointment funds itself.

The incentives are structural, not personal. SIP 2 obliges office‑holders to look for recoveries and submit conduct reports; SIP 9 and the Rules let them bill on a time‑cost basis within an agreed estimate, with later requests to raise the cap if needed. Settlement of marginal claims can become a commercial decision rather than a merits test. (icaew.com)

Directors do have earlier, safer options. HMRC will consider Time to Pay arrangements for VAT, PAYE and Corporation Tax if you propose affordable, evidenced instalments. The CIGA 2020 moratorium offers a short, court‑filed breathing space-initially 20 business days, extendable-while you remain in control under a monitor. For larger capital structures, the Part 26A restructuring plan can bind dissenting creditors if the court’s tests are met. (british-business-bank.co.uk)

If you sense resistance to these director‑led routes, understand the official preference for predictability. After consulting on replacing the Recognised Professional Bodies with a single regulator, ministers stepped back from that move and instead proposed a public register, firm‑level regulation and government‑set ethical standards-leaving licensed IPs central to delivery. (gov.uk)

Equally, be clear that not every ‘alternative’ is credible. The Insolvency Service shut down companies linked to the Atherton scheme and secured a nine‑year disqualification for a director installed across hundreds of firms after millions in assets went missing. That crackdown is a warning against any model that side‑steps creditor rights. (gov.uk)

What should you do in your next seven days? Get books and records up to date, reconstruct the director’s loan account with evidence, prepare a 13‑week cash flow, and open a documented dialogue with HMRC on a realistic Time to Pay. If you are already in a CVL process, ask your IP for a SIP 2 investigation plan, a full SIP 9 fee estimate with caps, and confirmation they will not exceed it without a formal decision procedure as the Rules require. (british-business-bank.co.uk)

If a formal appointment is unavoidable, choose your practitioner with the same scepticism you apply to any major supplier. Review their hourly rates and proposed staffing mix, ask who will actually do the work, and insist on clear milestones. Remember that creditors, not the IP, ultimately approve remuneration and can challenge charges in court if they believe they are excessive. (legislation.gov.uk)

The fear loop keeps spinning because it works commercially. It will slow only when directors are told, at the start, that insolvency is an adversarial, incentivised process-one where you are entitled to seek pre‑appointment corrections, consider protected breathing space and negotiate with creditors on evidence, not dread.